gucci vat | Gucci america address gucci vat The rules for who gets a VAT refund, procedures for how to get your money back and the amount the final refund will be vary widely depending on location, and navigating the process can be a bit tricky any time customs laws come in to play.

Bezskaidras naudas valūtas maiņu ir iespējams veikt Citadele internetbankā. Valūtas maiņas darījumam, kura vērtība pārsniedz EUR 7 000 (vai tā ekvivalentu), un kas veikts multivalūtu konta ietvaros, tiek piedāvāts uzlabotais kurss. Kursi ir informatīvi un var mainīties dienas laikā.

0 · Gucci jewelry company

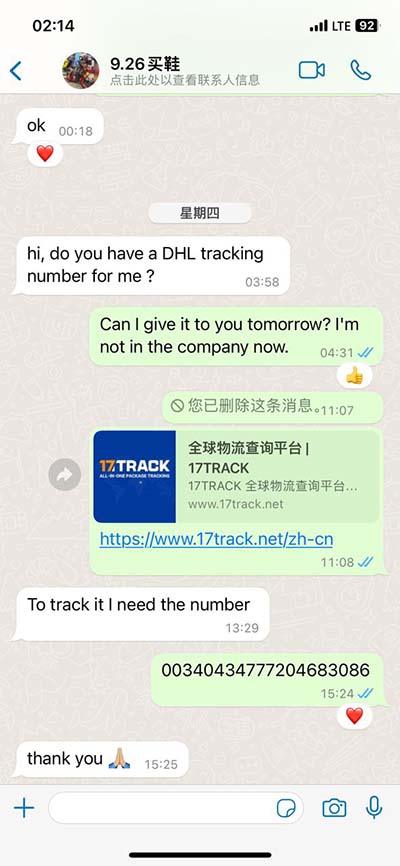

1 · Gucci email address

2 · Gucci corporate website

3 · Gucci america address

The easiest way to build D&D 5e spellbooks. Find out which spellcaster class is the best for you. Explore the spells index with all the control you need.

Guccio Gucci S.p.A. Company organised and existing under the laws of Italy with registered address at Via Tornabuoni 73/r, 50123 Florence, Italy. VAT: 04294710480. Tax Code - Register of enterprises of Florence: 03031300159. R.E.A. FI no. 438090.

Guccio Gucci S.p.A. Company organised and existing under the laws of Italy with registered .Guccio Gucci S.p.A. Company organised and existing under the laws of Italy with registered address at Via Tornabuoni 73/r, 50123 Florence, Italy. VAT: 04294710480. Tax Code - Register of enterprises of Florence: 03031300159. R.E.A. FI no. 438090.Guccio Gucci S.p.A. Company organised and existing under the laws of Italy with registered address at Via Tornabuoni 73/r, 50123 Florence, Italy. VAT: 04294710480 Learn how to shop tax-free at Gucci and many other stores, and obtain a VAT refund in cities like Rome, Milan, and Florence.

The rules for who gets a VAT refund, procedures for how to get your money back and the amount the final refund will be vary widely depending on location, and navigating the process can be a bit tricky any time customs laws come in to play. 1.1 The site and its contents are designed, operated and administered by Guccio Gucci SpA, an Italian incorporated sole ownership, with registered office in Via Tornabuoni 73r, 50123 Florence, VAT no. 04294710480, number of register of incorporation and Fiscal Code 03031300159, REA number FI-438090, share capital Euro 50,000,000 fully paid .

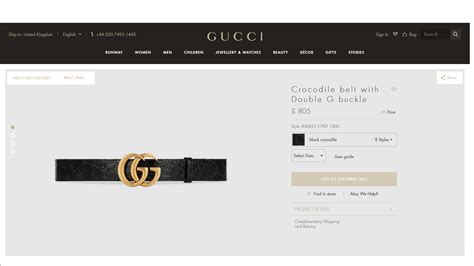

If the savings mentioned in this blog post don't seem enough for you, we've got 3 more ideas on how you can save big purchasing Gucci items. 1. Use your VAT refund. Value-added tax (VAT) is a tax added to the price of most goods and services in . The VAT refund was 9, making the Gucci bag only 2. If you bought the Gucci Soho bag in the U.S., it would cost you ,288.18 with tax. I saved 6 on the Gucci Soho bag by buying it in Europe with the VAT refund!

A group of global luxury brands including Gucci and De Beers has urged the government to abandon plans to end VAT-free shopping for international visitors.

At CDG, the stores are duty-free, so the VAT refund is already built into the price you pay. I bought the Zippy Wallet (normally 1 with sales tax) for 555 euro or 8.27. At Gucci, I bought the Ophelia GG wallet (in the US 4.70 with tax) for 375 euro, or 4.24. I bought a few things from Gucci and went to the planet kiosk in Milano, we flew back June 8, I tried to track my refund online and all the voucher numbers / item IDs/stamp numbers say not found. I’ll give it 6-8 weeks before I reach out to customer support.Guccio Gucci S.p.A. Company organised and existing under the laws of Italy with registered address at Via Tornabuoni 73/r, 50123 Florence, Italy. VAT: 04294710480. Tax Code - Register of enterprises of Florence: 03031300159. R.E.A. FI no. 438090.

Guccio Gucci S.p.A. Company organised and existing under the laws of Italy with registered address at Via Tornabuoni 73/r, 50123 Florence, Italy. VAT: 04294710480 Learn how to shop tax-free at Gucci and many other stores, and obtain a VAT refund in cities like Rome, Milan, and Florence. The rules for who gets a VAT refund, procedures for how to get your money back and the amount the final refund will be vary widely depending on location, and navigating the process can be a bit tricky any time customs laws come in to play. 1.1 The site and its contents are designed, operated and administered by Guccio Gucci SpA, an Italian incorporated sole ownership, with registered office in Via Tornabuoni 73r, 50123 Florence, VAT no. 04294710480, number of register of incorporation and Fiscal Code 03031300159, REA number FI-438090, share capital Euro 50,000,000 fully paid .

If the savings mentioned in this blog post don't seem enough for you, we've got 3 more ideas on how you can save big purchasing Gucci items. 1. Use your VAT refund. Value-added tax (VAT) is a tax added to the price of most goods and services in . The VAT refund was 9, making the Gucci bag only 2. If you bought the Gucci Soho bag in the U.S., it would cost you ,288.18 with tax. I saved 6 on the Gucci Soho bag by buying it in Europe with the VAT refund! A group of global luxury brands including Gucci and De Beers has urged the government to abandon plans to end VAT-free shopping for international visitors.At CDG, the stores are duty-free, so the VAT refund is already built into the price you pay. I bought the Zippy Wallet (normally 1 with sales tax) for 555 euro or 8.27. At Gucci, I bought the Ophelia GG wallet (in the US 4.70 with tax) for 375 euro, or 4.24.

Gucci jewelry company

gentlemen givenchy only

Luminor was founded in August 2017 on the basis of the Baltic operations of Nordea and DNB. [2] Luminor took over 930,000 of DNB's former customers and 350,000 of Nordea former customers. [2] The merger was completed on 1 January 2019. [1] Originally, Nordea owned 56.5% and DNB owned 43.5% of Luminor.

gucci vat|Gucci america address